Insurance for dentists

When it comes to insurance, we don't want you to simply go with the flow. Which is why at Guild, we're constantly evolving to reflect the real-life needs of dentists like you.

Join Guild Insurance today and choose to be protected by an insurer that's worked hand in hand with ADA NSW, ADA SA, ADAVB and ADATAS for over 25 years.

Professional indemnity and liability

Protects you for what you do as a dentist.

Business

insurance

Protects your dental practice and items in it.

Professional indemnity insurance covers you for your civil liability when a claim arises from a breach of your professional duty. For many professional policies at Guild Insurance combine professional indemnity, public liability, and product liability to cover more of your professional duties. Business insurance, on the other hand, is a broader category that encompasses various types of coverage designed to protect businesses from a wide range of risks. This can include property damage, theft, and liability claims from third parties.

For professionals providing advice or services:

- Assess your service risk: Evaluate the potential risks associated with your professional advice or services. Consider the possibility and implications of your advice or actions leading to a client's physical, psychological, or financial detriment. Reflect on the likelihood and consequences of a situation where an error or omission on your part could lead to legal action.

- Understand legal requirements: Familiarise yourself with the legal and regulatory landscape relevant to your profession. Is holding professional indemnity insurance a legal requirement or an industry standard in your field?

For certain contract positions and many allied health professionals regulated under Ahpra require professional indemnity and/or public liability insurance. - Consider your financial exposure: If faced with a legal claim, could you afford the legal defence and potential damages out of pocket?

For business owners protecting their operations:

- Identify your business assets: Determine which physical assets are crucial to your business operations, such as property, equipment, and inventory. Consider the consequences if these assets were damaged, stolen or lost.

- Evaluate liability risks: How likely is it that someone could be injured or their property damaged because of your business activities? This includes both public liability and product liability.

- Consider business interruptions: Think about the resilience of your business in the face of unforeseen events that might force temporary closure. How would such interruptions impact your financial stability?

If you are unsure of the cover you require, please contact us on 1800 810 213 to speak to an insurance specialist.

Key Product Features

Discover the limits and coverage built in to every Guild dentist liabilities policy.

Renewal FAQs

See the latest frequently asked questions and information for renewals in 2025.

Association Endorsed

Find out more about our long standing partnership with several branches of the ADA.

Hear from other dentists

01/09/2024

01/07/2024

01/01/2025

Working with over 130 associations

Insuring Australians for over 60 years

100% Australian owned

Learn how Dentists avoid claims with RiskHQ

Botox and Dermal Fillers in Dentistry

obligations and are able to comply with all relevant laws.

I’m thinking about doing a course to expand my scope – what do I need to know?

First, practitioners must ensure they have taken out an appropriate Professional Indemnity Insurance policy. This means being sure your policy will respond in the event of a treatment complication or adverse event arising. Guild Insurance’s professional indemnity policy has always covered dentists for claims related to the practice of dentistry within the practitioner’s scope of practice, including the use of Botox and dermal fillers. Non-Guild members should consult their provider regarding the extent of their policy cover.

Next, ensure you are familiar with all regulatory requirements. This means having a good understanding of the expectations of the Dental Board of Australia (DBA) - Fact sheet: The use of botulinum toxin and dermal fillers by dentists.

The Dental Board of Australia (DBA) expects dentists to practise in a manner that is consistent with:

> the definition of dentistry: “Dentistry involves the assessment, prevention, diagnosis, advice, and treatment of any injuries, diseases, deficiencies, deformities or lesions on or of the human teeth, mouth or jaws or associated structures.”

> the DBA’s Standards, Codes and Guidelines by :

- performing only those procedures that fall within their scope of practice i.e: for which the practitioner has been educated and trained and are competent to provide.

- maintaining a high level of professional competence, including obtaining informed consent.

The DBA expects clinicians to take into consideration all relevant state drugs and poisons legislation relating to the storage, use and supply of medicaments and by using scheduled medicines ‘for dental therapeutic use’ only. This means the prescription of medicaments must follow a dental diagnosis. It is recommended that clinicians clearly state their diagnosis and reason for prescription in the clinical record.

> the requirements of the Therapeutic Goods Administration (TGA):

- dentists should only purchase products registered on the Australian Register of Therapeutic Goods (ARTG) for legal supply in Australia.

- comply with advertising cosmetic injections restrictions .

- advise patients that the use of botulinum toxin and dermal fillers is considered “off label” and experimental only. All risks must be explained and informed consent obtained in writing.

The DBA expects dentists to refer patients:

> when the treatment required by the patient is outside the personal scope of the individual dentist (but still within the definition of dentistry) to another dentist or dental specialist OR

> when the proposed treatment is outside the definition of dentistry, to a medical practitioner.

What does the “Practice of Dentistry” and “Associated Structures” mean?

practitioners exercise their professional judgement as to which anatomical structures are included in their care.

Do the new Ahpra guidelines for cosmetic surgery apply?

The new Australian Health Practitioner Regulation Agency (Ahpra) guidelines for practitioners performing cosmetic surgery and procedures come into effect as of July 2023. Intended for medical practitioners, it is nevertheless worthwhile noting there is a requirement for practitioners performing injectables and non-surgical treatments to “assess the patient’s reasons and motivation for requesting the procedure… The patient’s expectations… must be discussed to ensure they are realistic.” To support patients, Ahpra have published a patient factsheet on cosmetic injectables .

Which is the correct item code for injection of botulinum toxin and dermal fillers?

The Australian Dental Association (ADA) publication The Australian Schedule of Dental Services and Glossary – Thirteenth Edition – includes the following relevant item codes and descriptors:

> 929 – Provision of neuromodulator therapy #

Injection of neuromodulators for the treatment of oral and maxillofacial diseases and disorders.

> 987 – Recontour tissue – per appointment #

Recontour of oral and associated tissue not described elsewhere in the Thirteenth Edition of the Australian Schedule of Dental Services and Glossary, such as the injection of dermal fillers.

Will private health insurers pay a

benefit for treatment that includes

botulinum toxin and dermal fillers?

Private Health Insurers have different rules and different policies when it comes to the treatments for which they will pay a benefit. Patients should be encouraged to contact their health fund to ascertain this information.

- Dentists

- Professional

- Patients

- Treatment

- Treatment Planning

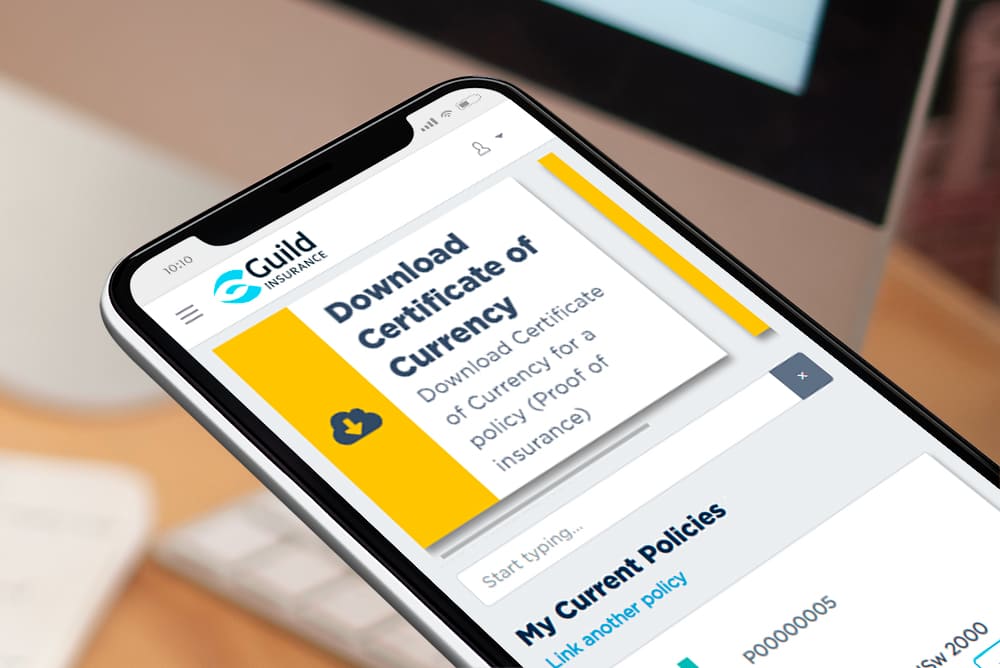

Login to PolicyHub for all your policy needs

- All-In-One Dashboard: Manage all your policies and documents in one place.

- Easy Updates: Quickly update personal and business details online.

- Enhanced Security: Protect your account with multi-factor authentication.

- Document Access: Instantly access policy documents and tax invoices.

- Claim Management: View current and past claims effortlessly.

- Flexible Payments: Update billing details.

- Policy Renewal & Reinstatement: Renew or reinstate policies with ease directly through PolicyHub.

- Certificates of Currency: Obtain proof of insurance with just a few clicks.

FAQs

The law governs that any professional exercise the required skill to an appropriate level expected by that profession. A professional may be liable for financial loss, injury or damage arising from an act, error or omission of fault if the professional has not acted to the required level of skill deemed in that profession. Failure through this may result in the claimant (person who suffered the loss) be awarded for that loss, damage or injury.

Many professions require you to hold a professional indemnity insurance policy by law, such as Ahpra registered professions, but can be for other industries such as financial institutions also. Please check with your registration body or associations of your profession to know if it is required by law to have professional indemnity insurance. It is often also required by companies who take on contract workers that are not governed under the companies own insurance policy. It is acceptable for a company to ask you as the professional contractor to provide evidence of cover for professional indemnity before starting the contract period.

As stated above professional indemnity insurance covers you for breaches in relation to your professional duty. Liability insurance covers you for activity that results in personal injury or property damage as a result of your business activities that do not relate to your specific profession. An example may be someone who trips and is injured from spilled water within your office may be covered under liability, because it is your duty of care as business person to provide a safe environment. Whereas a person who suffers a loss or injury because of your professional treatment in relation to your job has caused it would usually be consider as an indemnity breach.

Generally business insurance is to cover the physical assets of your business for material damage loss and options for theft cover. It can also include cover for financial loss due to business interruption. Usually basic insurance does not cover breach of duty or flood cover, but if you speak to an insurance specialist it can often be added to your policy for a nominal fee.

Depending on the policy you are taking out, covers will often vary. At Guild insurance we specialise in making a policy to suit your business so that you are not over paying for covers you wouldn't normally need. The best thing to do is call 1800 810 213 to speak to an insurance specialist, they can find out what activities and structure your business is in to then provide you with adequate cover for you.

A certificate of currency (or COC for short) is a written document that confirms that your insurance policy is current and valid at a specific date and time. At Guild we provide easy access to your COC at any time within a few clicks of our online portal PolicyHub. If you are a new customer we can provide you with one post purchase.

Write a review Average rating: