Insurance for dentists

When it comes to insurance, we don't want you to simply go with the flow. Which is why at Guild, we're constantly evolving to reflect the real-life needs of dentists like you.

Join Guild Insurance today and choose to be protected by an insurer that's worked hand in hand with ADA NSW, ADA SA, ADAVB and ADATAS for over 25 years.

Professional indemnity and liability

Protects you for what you do as a dentist.

Business

insurance

Protects your dental practice and items in it.

Professional indemnity insurance covers you for your civil liability when a claim arises from a breach of your professional duty. For many professional policies at Guild Insurance combine professional indemnity, public liability, and product liability to cover more of your professional duties. Business insurance, on the other hand, is a broader category that encompasses various types of coverage designed to protect businesses from a wide range of risks. This can include property damage, theft, and liability claims from third parties.

For professionals providing advice or services:

- Assess your service risk: Evaluate the potential risks associated with your professional advice or services. Consider the possibility and implications of your advice or actions leading to a client's physical, psychological, or financial detriment. Reflect on the likelihood and consequences of a situation where an error or omission on your part could lead to legal action.

- Understand legal requirements: Familiarise yourself with the legal and regulatory landscape relevant to your profession. Is holding professional indemnity insurance a legal requirement or an industry standard in your field?

For certain contract positions and many allied health professionals regulated under Ahpra require professional indemnity and/or public liability insurance. - Consider your financial exposure: If faced with a legal claim, could you afford the legal defence and potential damages out of pocket?

For business owners protecting their operations:

- Identify your business assets: Determine which physical assets are crucial to your business operations, such as property, equipment, and inventory. Consider the consequences if these assets were damaged, stolen or lost.

- Evaluate liability risks: How likely is it that someone could be injured or their property damaged because of your business activities? This includes both public liability and product liability.

- Consider business interruptions: Think about the resilience of your business in the face of unforeseen events that might force temporary closure. How would such interruptions impact your financial stability?

If you are unsure of the cover you require, please contact us on 1800 810 213 to speak to an insurance specialist.

Key Product Features

Discover the limits and coverage built in to every Guild dentist liabilities policy.

Renewal FAQs

See the latest frequently asked questions and information for renewals in 2025.

Association Endorsed

Find out more about our long standing partnership with several branches of the ADA.

Hear from other dentists

01/09/2024

01/07/2024

01/01/2025

Working with over 130 associations

Insuring Australians for over 60 years

100% Australian owned

Learn how Dentists avoid claims with RiskHQ

Acknowledging and dealing with adverse dental outcomes

Dentists need to acknowledge that adverse outcomes are an unfortunate, yet very real, aspect of dentistry. Although dentists may do all they can to avoid these outcomes, they won’t ever be completely eliminated from dentistry, or any other area of healthcare. Therefore, it’s vital that all dentists have considered how they’ll manage an adverse outcome should the situation arise.

What to do following an adverse outcome

One of the first steps a dentist must take when there’s been an adverse outcome is to discuss this with the patient. It’s acknowledged this is a very challenging thing to do, however it’s incredibly important. It’s well recognised that patients appreciate a healthcare professional being upfront and honest with them by informing them of what’s occurred and what this means for their specific situation.

Many practitioners are hesitant to say sorry when informing a patient of an adverse outcome. There’s often a concern that this may mean they’ve admitted guilt and are then more likely to be held accountable. However, Australian legislation makes it clear that an apology is not an admission of liability. It’s best to avoid statements such as “I’m sorry I’ve done this to you” as this may be considered an admission. An apology needs to be carefully worded and can be as simple as “I’m sorry this has occurred”.

When having this conversation with patients, it’s important to give them opportunities to ask questions. It needs to be a balanced two-way conversation, not just information given by the dentist. This will ensure the patient has a greater understanding of what’s occurred and what the implications are for them. It also assists the patient in feeling part of the treatment process and decision making moving forward.

It’s common to hear patients state that they want to know what the practitioner and practice is going to do to avoid a similar situation occurring again to either themselves or other patients. This means you need to explain to the patient what you’ll do to understand why the adverse outcome occurred and what measures you’ll put in place to reduce the likelihood of it happening again.

Why are these conversations difficult?

It’s not uncommon for a practitioner to struggle having this open and honest conversation with a patient following an adverse outcome. This isn’t surprising given many people find it challenging to initiate difficult conversations.

In many cases the patient will know there’s been a poor outcome as it’ll be obvious to them. In these cases, there is no avoiding the conversation as the patient will probably confront the dentist. However, there’ll be occasions where the patient isn’t aware, such as when a file has fractured during RCT. There may sometimes be a temptation for a dentist to not inform patients of these cases, possibly thinking they don’t need to know. However, this is not an acceptable way to practice. Patients have a right to be informed about their health outcomes and dentists have an obligation to keep them informed.

Acknowledging and dealing with adverse outcomes in dentistry.

There are a number of reasons why a dentist may find these conversations challenging, such as:

- Dentists may be concerned that informing patients of what went wrong and why may increase the likelihood of a formal complaint and demand for compensation.

- The outcome may be a surprise to the dentist, leaving the dentist thinking “I never thought this would happen to me”. If the dentist is struggling to understand what went wrong and why, explaining it to the patient is going to be difficult.

- A dentist may be concerned they’re admitting to professional incompetence.

- A dentist may be worried the conversation will lead to professional or financial repercussions for the dentist or practice.

Benefits of a well handled adverse outcome

There are obvious benefits for both dentists and patients when a poor outcome is well managed.

When a patient has lodged a formal complaint about a health experience, it’s quite common for them to state that they’ve done so as a means for obtaining information and or an apology regarding what occurred and why. It seems that when a situation is not well explained to the patient, they may feel the need to take the matter further, such as a formal complaint, to get the information they need. It also seems that a patient may lodge a complaint when they feel their concerns have been dismissed and they haven’t received an appropriate acknowledgement or apology.

This is evidence of two things:

- Patients don’t necessarily complain for financial or malicious means. It’s easy to assume that patients complain because they want to receive financial compensation or because they want there to be repercussions for the practitioner who has harmed them. While these may be influential factors in some cases, they aren’t in all situations. There are situations where a patient complains simply to receive further information.

- An open and honest conversation may prevent some complaints from occurring. If the patient feels the dentist has been up front with what’s occurred, has provided a commitment to rectify the situation and has provided information about how the situation will be prevented in future, many patients may not feel a need to formally complain. They may also be more likely to continue treatment with that dentist as the relationship and trust still exists.

In summary…

Dentists need to remember that they have an obligation as a registered health professional to provide their patients with honest information following an adverse outcome. However, being obliged to do this shouldn’t be the only reason it’s done.

It’s well recognised that patients expect and appreciate this honest conversation. And having this conversation can go a long way towards the patient deciding whether or not to lodge a formal complaint and whether to continue being treated by that dentist.

- Dental Prosthetists

- Dentists

- Professional

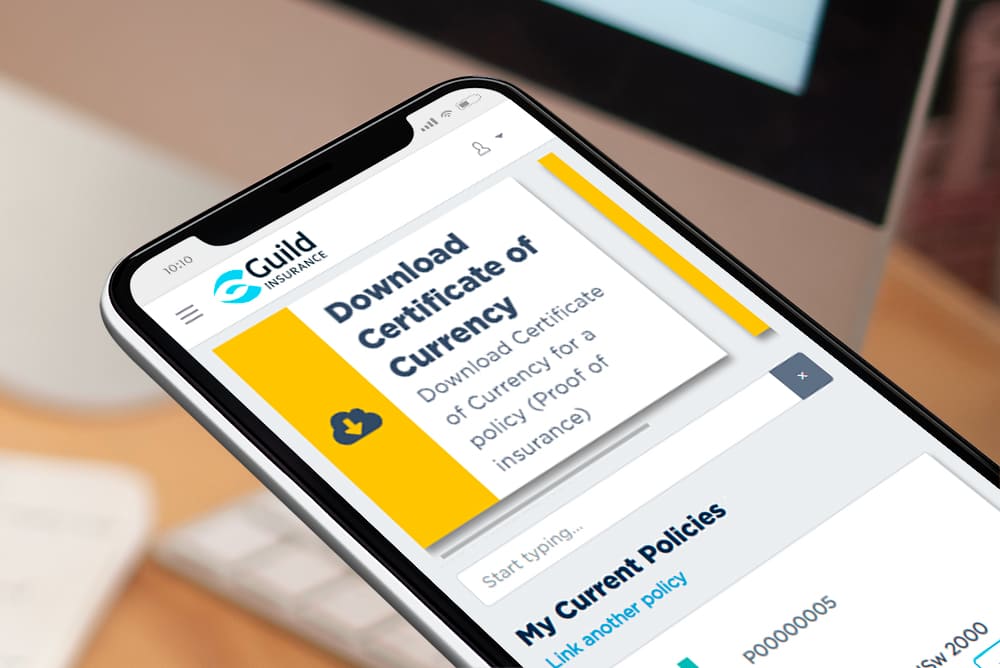

Login to PolicyHub for all your policy needs

- All-In-One Dashboard: Manage all your policies and documents in one place.

- Easy Updates: Quickly update personal and business details online.

- Enhanced Security: Protect your account with multi-factor authentication.

- Document Access: Instantly access policy documents and tax invoices.

- Claim Management: View current and past claims effortlessly.

- Flexible Payments: Update billing details.

- Policy Renewal & Reinstatement: Renew or reinstate policies with ease directly through PolicyHub.

- Certificates of Currency: Obtain proof of insurance with just a few clicks.

FAQs

The law governs that any professional exercise the required skill to an appropriate level expected by that profession. A professional may be liable for financial loss, injury or damage arising from an act, error or omission of fault if the professional has not acted to the required level of skill deemed in that profession. Failure through this may result in the claimant (person who suffered the loss) be awarded for that loss, damage or injury.

Many professions require you to hold a professional indemnity insurance policy by law, such as Ahpra registered professions, but can be for other industries such as financial institutions also. Please check with your registration body or associations of your profession to know if it is required by law to have professional indemnity insurance. It is often also required by companies who take on contract workers that are not governed under the companies own insurance policy. It is acceptable for a company to ask you as the professional contractor to provide evidence of cover for professional indemnity before starting the contract period.

As stated above professional indemnity insurance covers you for breaches in relation to your professional duty. Liability insurance covers you for activity that results in personal injury or property damage as a result of your business activities that do not relate to your specific profession. An example may be someone who trips and is injured from spilled water within your office may be covered under liability, because it is your duty of care as business person to provide a safe environment. Whereas a person who suffers a loss or injury because of your professional treatment in relation to your job has caused it would usually be consider as an indemnity breach.

Generally business insurance is to cover the physical assets of your business for material damage loss and options for theft cover. It can also include cover for financial loss due to business interruption. Usually basic insurance does not cover breach of duty or flood cover, but if you speak to an insurance specialist it can often be added to your policy for a nominal fee.

Depending on the policy you are taking out, covers will often vary. At Guild insurance we specialise in making a policy to suit your business so that you are not over paying for covers you wouldn't normally need. The best thing to do is call 1800 810 213 to speak to an insurance specialist, they can find out what activities and structure your business is in to then provide you with adequate cover for you.

A certificate of currency (or COC for short) is a written document that confirms that your insurance policy is current and valid at a specific date and time. At Guild we provide easy access to your COC at any time within a few clicks of our online portal PolicyHub. If you are a new customer we can provide you with one post purchase.

Write a review Average rating: